Explain the Differences Between Taxable Income and Adjusted Gross Income

A 2011 study titled Divided we Stand. A tax lawyer will explain how that can be done.

Taxable Income Formula Calculator Examples With Excel Template

Is not a separate taxpaying entity.

/tax_shutterstock_584351497-5bfc325b46e0fb00511aeca8.jpg)

. Income Tax Tax Brackets and Deductions Explained. The amount varies between provinces and is adjusted most years. In 1820 the ratio between the income of the top and bottom 20 percent of the worlds population was three to one.

Why Inequality Keeps Rising by the Organisation for Economic Co-operation and Development OECD sought to explain the causes for this rising inequality by investigating economic inequality in. Income tax payable and answer frequently asked questions about income tax expense. However income set aside on or before the date for filing Form 990-T including extensions of time may at the election of the organization be treated as having been set aside in the tax year for which the return was filed.

Low-income countries tend to have a higher dependence on trade taxes and a smaller proportion of income and consumption taxes when compared to high-income countries. 62 5A 17 or 17A or by regulation in order to determine the base amount of income to be multiplied by the. DIFFERENCES BETWEEN FEDERAL AND WISCONSIN TREATMENT AND HOW TO REPORT Even though federal adjusted gross income is used as the starting point for computing Wisconsin taxable income the amounts of capital gain or loss includible in Wisconsin and federal income may differ for a particular taxable year.

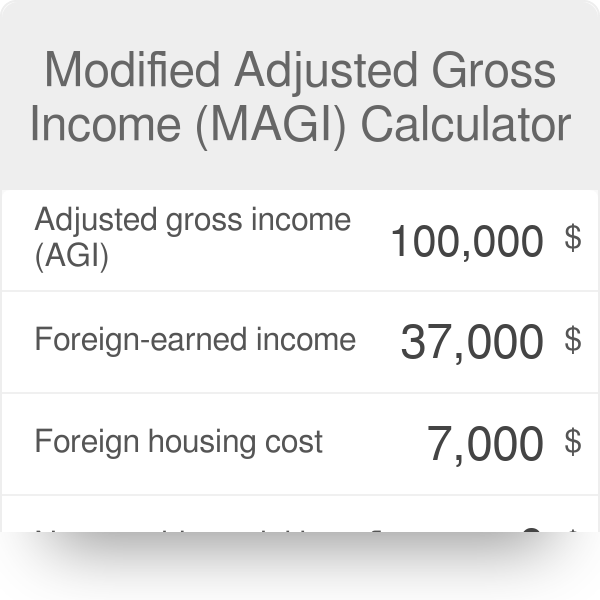

However there are continuing differences between California and federal law. See Modified adjusted gross income AGI earlier. Tax haven which is deemed to exist when the non-Mexican resident income is not subject to taxation or taxed at an effective taxation lower than 75 of the tax that would be paid in Mexico or.

When California conforms to federal tax law changes we do not always adopt all of the changes made at the federal level. This net income election is available only if the foreign shareholder income is not deemed to be subject to a regime considered as a preferred tax regime jurisdiction ie. 1 Modified AGI adjusted gross income.

By 1991 it was eighty-six to one. National Insurance contributions NICs are the UKs second-biggest tax expected to raise almost 150 billion in 202122 about 20 of all tax revenue. Provided you earn less than approximately 50000 annually in dividend income.

Taxable Net Income the part of the net income of a taxpayer derived from the taxpayers business activities carried on in Massachusetts and which is adjusted as required by the applicable provisions of MGL. Investors who have other sources of income can still benefit from paying less tax on dividends than they would if they had earned that income directly. In this article we explain what income tax expense is describe how to calculate income tax expense provide an example of income tax expense highlight the differences between income tax expense vs.

63 38a or MGL. The differences in life expectancy across commuting zones were similar in analyses with income measures adjusted for cost of living controls for differences across areas in the income distribution within each quartile or measures of loss in life years up to the age of 76 years that did not make use of Gompertz extrapolations part IVC of the eAppendix and eTable 6 in. 2 If you didnt live with your spouse at any time during the year your filing status is considered Single for this purpose therefore your IRA deduction is determined under the Single filing status.

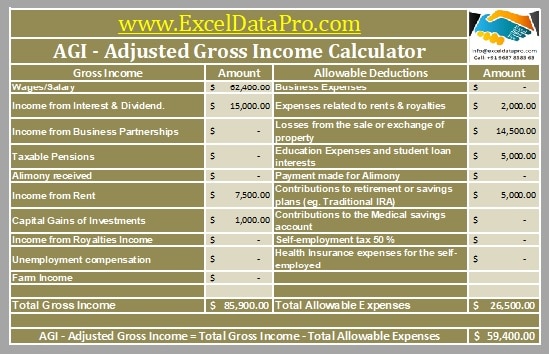

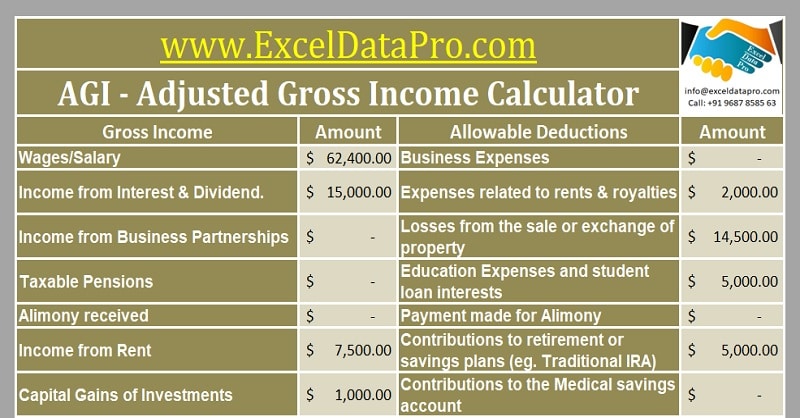

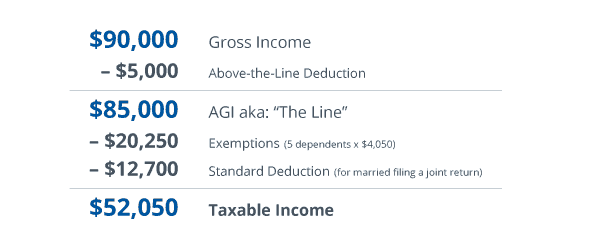

However it is usual to calculate the taxable income or the gross income and deductions arising from the partnerships activities as if the partnership were a separate taxpayer in respect of that income for the purpose of determining the tax liability of the partners. See generally infra ch. Adjusted gross income is the difference between an individuals gross income that is income from any source that is not exempt from tax and deductions for certain expenses.

Set-aside income is generally excluded from gross income only if it is set aside in the tax year in which it is otherwise includible in gross income. These deductions are referred to as adjustments to income or above the line deductions. 66 One indicator of the taxpaying experience was captured in the Doing Business survey 67 which compares the total tax rate time spent complying with tax procedures and the number of payments required.

In general for taxable years beginning on or after January 1 2015 California law conforms to the Internal Revenue Code IRC as of January 1 2015.

Agi Calculator Adjusted Gross Income Calculator

What Is Adjusted Gross Income Agi And How Do You Calculate It Smartasset

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

/GettyImages-88305470-1--57520b1c5f9b5892e8bfc1a0.jpg)

Adjusted Gross Income Agi Definition

What Is Adjusted Gross Income H R Block

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

What Is Adjusted Gross Income Agi Gusto

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Adjusted Gross Income Agi Definition Taxedu Tax Foundation

What Is Adjusted Gross Income Agi Nerdwallet

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Standard Deduction Tax Exemption And Deduction Taxact Blog

Comments

Post a Comment