I Paid Alimony Which Free Online Can I Use

You can deduct alimony paid to or for a spouse or former spouse under a divorce or separation decree regardless of whether you itemize deductions. The Tax Cuts and Jobs Act TCJA came into effect in December 2017 resulting in significant changes in alimony taxes.

Alimony Payments Taxes Of Divorced Separated Individuals

Report the total amount you paid on line 19a of the 2021 Schedule 1 then transfer the total from this section Adjustments to Income to line 10 of the 2021 Form 1040.

. Beginning in 2019 the rule for reporting alimony paid as a deduction has changed. Claiming Alimony Youve Paid as a Deduction. Click on the Federal Taxes tab Deductions.

Click to show all tax breaks. Click Taxes Tax Timeline Take me to my return. Divorce can be a complicated process especially if you and your spouse have children or a large number of assets involved.

Team of trusted lawyers dedicated to your future. Call Our Offices for free consult. Similarly the recipient must report the amount as income and pay tax.

You can only report your alimony payments as a tax deduction only if you finalized your divorce by December 31 2018. Prepayment of Alimony is not Tax Deductible. The Date of the Divorce.

Following are nine tactics you can use to keep more of the money you earn and avoid paying alimony. Zddoodah Jan 8 2018. If a judge has ordered alimony it must be paid and the payer can be held accountable for failing to pay.

By him using his business account to pay alimonychild support it may force him to open up his business books for audit should be attempt to change his payment schedule. Alimony or separation payments paid to a spouse or former spouse under a divorce or separation agreement such as a divorce decree a separate maintenance decree or a written separation agreement may be alimony for federal tax purposes. You will enter the amount on line 2a.

Alimony payments can be ordered to start while the divorce is still pending in court which is known as interim or temporary alimony 2 and for a period of time after the divorce is finalized. Alimony is an obligation to make payments for support or maintenance. Scroll down until you see Other Deductions and Credits and click Show More.

Under federal tax laws alimony payments are deductible but only if they meet all of the legal requirements. This comes from the average of all equations listed below. The court will determine how long you or the other party will receive alimony.

A periodic pre-determined sum awarded to a spouse or former spouse following a separation or divorce. Lowest monthly payment for alimony. Where to report alimony on your tax return.

However one can also pay it in a lump sum. If limiting the term of alimony is important in your divorce get the assistance early on of an experienced attorney who can help you be best positioned to. Alimony awards may be paid as a lump sum or in monthly installments.

Click Start next to Alimony. Or the alimony may be front loaded so long as care is taken with regard to certain tax issues so that funds can be saved for use in the years after alimony ends on a specified date. Recipients of alimony are no.

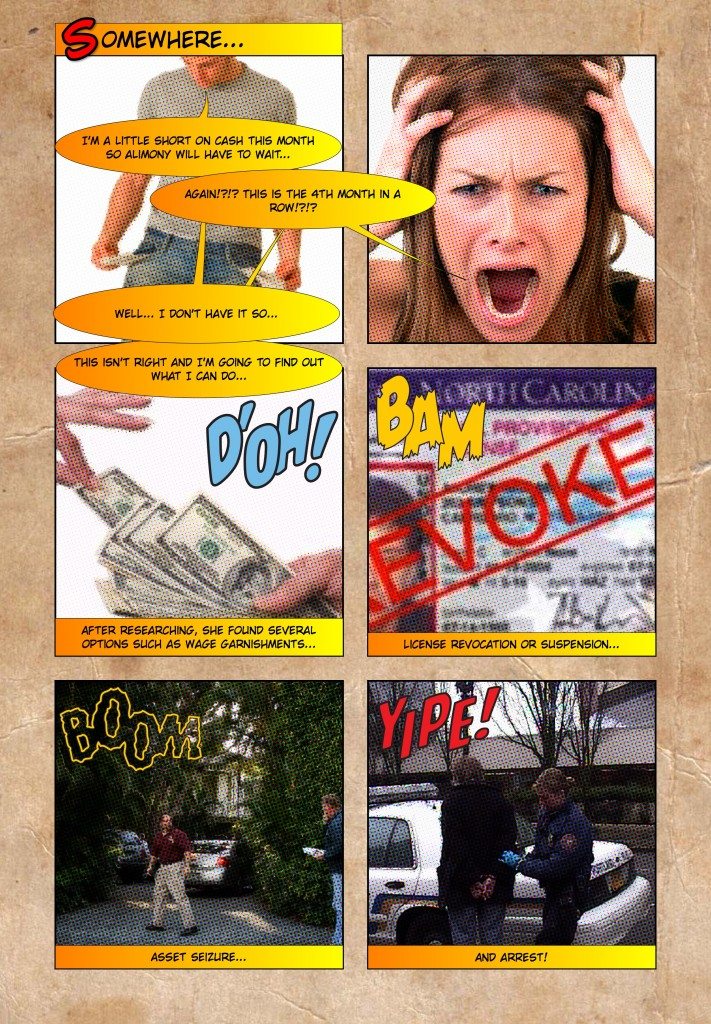

What to do when court-ordered alimony is not being paid. The amount and duration of alimony payments is usually based on several factors as established by state law. If you have been married for 20 years or longer there is no limit to how.

You should consult with your tax accountant if you plan to make your alimony payment in a lump sum. Our most popular destinations for legal help are below. Ad Experienced New Jersey Divorce Family Law Attorneys.

Schedule 1 also asks you to enter your ex-spouses Social Security number as well as the date of your divorce decree or. Alimony or separation payments are deductible if the taxpayer is the payer spouse. To enter alimony you paid last year in TurboTax please take the steps below.

This comes from the below calculation click the formula below to learn more. If your spouse has been ordered to pay alimony but is refusing to do so you can file a motion in court and the spouse could be held in contempt. If you have a divorce agreement finalized before January 1 2019 reporting alimony paid and received on your tax return is easy.

If youre the person receiving alimony payments. The payments last until the divorce comes up with a final decision. One of the most important requirements is that alimony payments must be paid in connection with a divorce or separation instrument which means a written agreement or court order.

There are multiple types of alimony Temporary Alimony Its given at the time of divorce proceedings. Avoid Paying It In the First Place. Alimony or spousal support is financial support that one spouse pays to another spouse usually because the resource or earning capacity of the spouses is quite different.

Unless the courts order for alimony says its something that can be used then the alimony will need to be paid by cash check or money order. If the couple spent 5 years or less then the dependent spouse will get alimony for about 50 of the number of months the couple spent together. The best way to get out of making alimony payments is to avoid the need to make them in the first place.

Alimony payments will not last a lifetime. Jan 10 2018 8. Average monthly payment for alimony.

Odds are your attorney will want you to keep a detailed record of the accounts being drawn on and when you receive payments. Zddoodah Jan 8 2018 7. Chief Counsel Advice CCA 200251004 provides that a payer is permitted to deduct alimony payments paid to a foreign recipient on the payers US.

Alimony can be paid as a lump sum or paid on an ongoing basis. Sign into TurboTax Online. Deductions for alimony orders executed after December 31 2018 have been eliminated.

Tax return even if the recipient as a resident of a treaty country is not required to pick up the alimony as income. To Enter those deductions please follow the steps below. Can I report alimony I paid.

Once you have entered the return please find and click on. Permanent Alimony It is given to one spouse until their death retirement or remarriage. Depending on your circumstances the court may order you to provide alimony to your former spouse or financial support paid by one spouse to another after a divorce.

The judge will decide depending on the qualifications and ability of the non-working spouse for how long will the alimony be paid. Log into your TurboTax Account and select your 2016 Tax Return from the TImeline. You simply input alimony paid or received on Form 1040 Schedule 1.

This can result in fines and penalties. Prior to 2019 the paying spouse could deduct support payments from their tax return and the spouse receiving support had to pay the taxes.

Ex Husband Won T Pay Alimony Midlife Divorce Recovery

Average Duration Of Alimony Payments Lovetoknow

Ex Not Paying Child Support Here S What You Can Do Divorcehow Com

Tax Pain Alimony Payments For Us Expats

Brendan Fraser S Alimony Payments Ended On January 31st R Mademesmile

Will I Still Have To Pay Alimony If I Have A Prenuptial Agreement Nyc Long Island Divorce Weisman Law Group Pc

What Happens If You Don T Pay Alimony

Alimony Calculator India Divorce Maintenance Rules

Congratulations On Your Eventual Divorce Your Bonus Prizes Are Alimony And Child Support Divorce Divorce Child Support Divorce Online

Sample Alimony Letters Lovetoknow

How To Collect Alimony When Your Ex Won T Pay

Pin On Idea Book Graphic Communications

How To Avoid Paying Alimony To A Cheating Spouse With Pictures

![]()

Concept Of Paying Alimony Envelope Calculator Pen Eyeglasses Icon Stock Vector Illustration Of Agreement Child 216060305

All Over The World Millionaires And Billionaires As I Do Also Are Handing Out Cash To Those T Child Support Quotes Take Surveys For Money Ways To Save Money

He Cheated She Has To Pay Alimony What The Hell

/GettyImages-1160635469-b05334731f904919a2edf1e70a71ac41.jpg)

Comments

Post a Comment